PayPal is the undisputed king of the virtual charge scene. It has over 360 million active customers in over 200 countries and processed 4 billion charge transactions in the third quarter of 2020 alone. PayPal provides customers to make purchases, ship, and receive money online since 1998. PayPal allows you to pay for items online using a bank account rather than a credit card and keeps your credit card information hidden from merchants. It also makes sending money simple and, in most cases, free. PayPal has effectively rendered exams and high-priced cord switch services obsolete. All you need to know about what PayPal is and How do you qualify for a PayPal loan ?

What exactly is PayPal?

To answer the above question, PayPal is a dependable virtual charge machine that entered the market in 1998 and revolutionized people’s shopping to receive money and make online purchases. By linking your bank account to your PayPal account, you can avoid time-consuming and cumbersome methods of sending money like checks, wire transfers, and debit cards.

What exactly is PayPal Credit?

PayPal Credit is the company’s credit program. It functions similarly to a virtual credit card, but it can only get used to making online payments on websites that accept PayPal. PayPal Credit allows you to defer payments like a traditional credit card.

How does PayPal operate?

It’s a digital payment service that lets you send and receive money through your PayPal account with your bank account. The fact that most transactions are free and your information is secure and hidden from merchants makes this service the icing on the cake. PayPal allows you to conduct a wide range of transactions. It is widely used as a payment service when shopping online; you can use it to send and receive money, and there is even a process for withdrawing money.

Types of PayPal Accounts:

Now we look at how it works and whether or not there is a fee. Let’s go head over the service’s account types.

Personal Accounts:

The basic personal account for sending and receiving money and making online purchases. Additional bank accounts and credit cards can get linked to your PayPal account.’

Business accounts:

‘PayPal business accounts enable businesses to receive money in the app and accept credit and debit cards from customers even if they do not have the app. It has evolved into a quick, simple, and secure method for businesses, particularly those in the service industry, to accept payment from their customers.

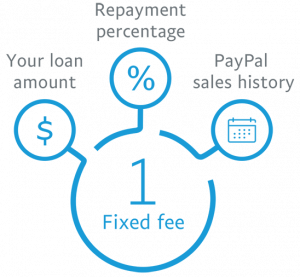

How do you get approved for a PayPal loan?

How do you qualify for a PayPal loan ? To be eligible for a PayPal loan, you must have an active PayPal account with a verified email address and a bank account. You must also meet the requirements for the specific loan for applying.

Is it simple to obtain PayPal business credit?

Yes, as long as you meet the eligibility requirements, PayPal business credit is relatively easy to obtain. There are a few eligibility requirements that you must meet to qualify for PayPal business credit, but they are all straightforward. It is important to note that to receive the loan, you must have a PayPal business account.